The Future of Auto Insurance: AI and E-Policies

As the Canadian auto insurance landscape evolves, artificial intelligence (AI) is revolutionizing the way e-policies are created, managed, and utilized. This digital transformation is bringing unprecedented benefits to both insurers and policyholders alike.

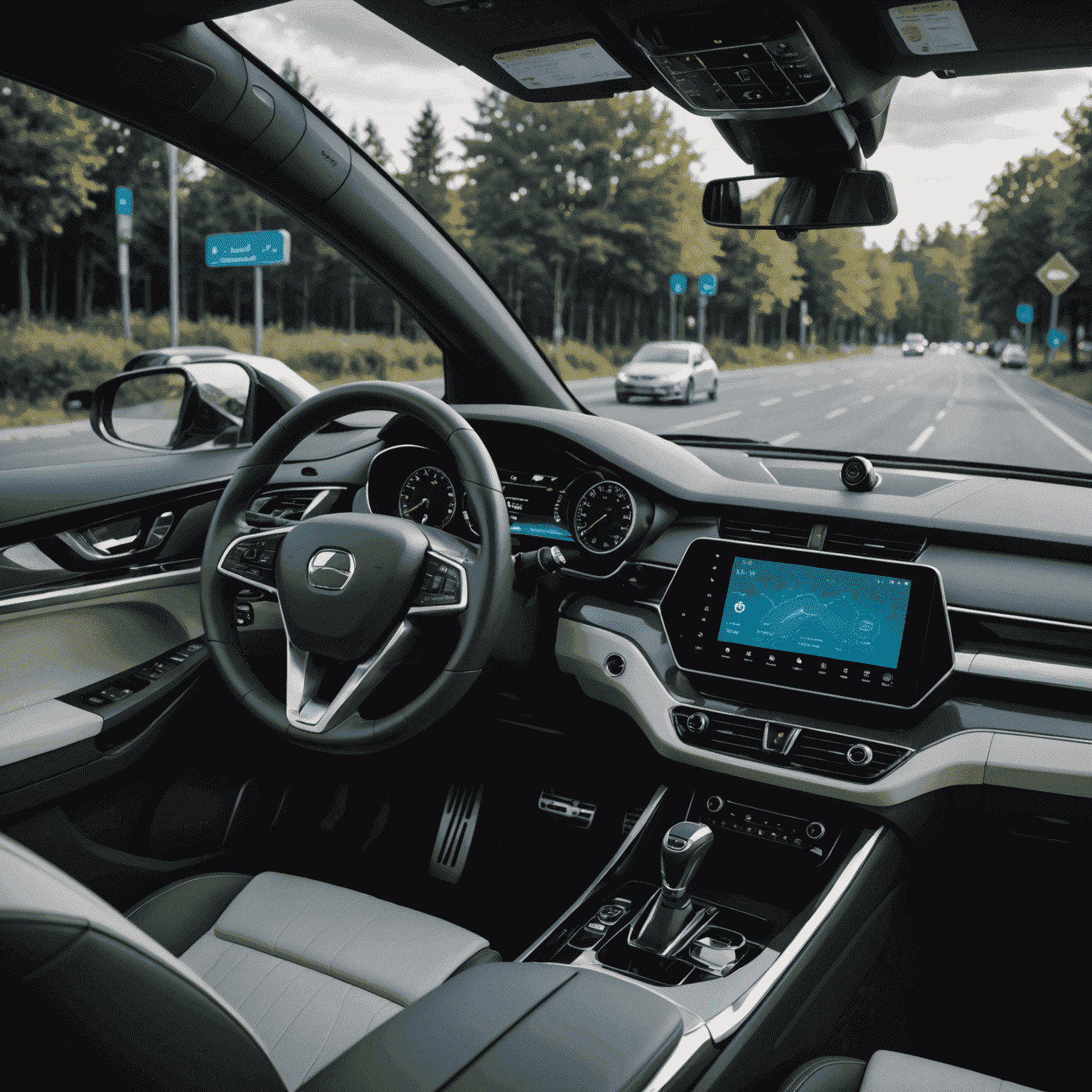

The Rise of AI in Auto Insurance

AI is reshaping the auto insurance industry by enabling more accurate risk assessment, personalized pricing, and streamlined claims processing. E-policies, powered by AI algorithms, can now adapt in real-time to changing driving behaviors and environmental factors.

Key Benefits of AI-Driven E-Policies:

- Dynamic pricing based on individual driving patterns

- Instant policy updates and modifications

- Automated claims processing for faster settlements

- Predictive maintenance alerts to prevent accidents

- Enhanced fraud detection capabilities

The Digital Age Advantage

E-policies are at the forefront of this digital revolution, offering numerous advantages over traditional paper policies:

- Accessibility: Policyholders can access their insurance information anytime, anywhere through secure online portals or mobile apps.

- Customization: AI allows for highly personalized coverage options tailored to individual needs and driving habits.

- Efficiency: Paperless processes reduce administrative costs and environmental impact.

- Transparency: Real-time updates and clear digital documentation improve understanding of coverage and terms.

- Integration: E-policies can easily integrate with other digital services, such as vehicle telematics and smart home systems.

The Canadian Perspective

In Canada, the adoption of AI-driven e-policies is gaining momentum. Insurance companies are investing heavily in technology to stay competitive and meet the evolving expectations of tech-savvy consumers. This shift is particularly significant in urban centers where digital literacy is high and the demand for innovative insurance solutions is growing.

Challenges and Considerations

While the future of auto insurance looks promising with AI and e-policies, there are challenges to address:

- Ensuring data privacy and security in an increasingly connected world

- Bridging the digital divide to make e-policies accessible to all demographics

- Adapting regulations to keep pace with technological advancements

- Balancing automation with the human touch in customer service

Conclusion

The fusion of AI and e-policies is set to transform the auto insurance landscape in Canada. As technology continues to evolve, we can expect even more innovative solutions that will make insurance more accessible, affordable, and tailored to individual needs. The future of auto insurance is digital, and it's arriving faster than we might think.

"The integration of AI in e-policies is not just a trend; it's the future of auto insurance. It's about creating a more responsive, efficient, and user-centric insurance experience for all Canadians."